The WhiteStone Way

Our Philosophy

We view wealth management differently than many others. We do not believe that the traditional method of asking a prospective client 8 to 10 questions about risk preferences and their age, and then using that data to allocate their portfolio, is a viable strategy. We believe that assets should be managed according to when they will be spent, with close attention being paid to risk-taking. That means managing:

- The risk of the client to avoid investment loss on any assets earmarked for spending

- The risk of the manager (not the fund) over an extended period of time

- The risk of the market with well-designed exit strategies

As a registered investment advisory firm, we take our role as a fiduciary very seriously. That means we will always act in a client’s best interest, and that is why we believe mitigating risk is so essential to properly managing wealth. As author and television personality, David Bach is known for saying:

“What determines your wealth is not how much you make but how much you keep of what you make.”

Traditional vs. Endowment

Many financial plans still today are constructed on model that was introduced over 50 years ago. The premise was that a portfolio comprised of 60% stocks and 40% bonds could provide better risk-adjusted returns over time than one comprised of just stocks or bonds. And while this approach has performed well for many investors over the years, in our opinion, it is not well equipped to do so in the future.

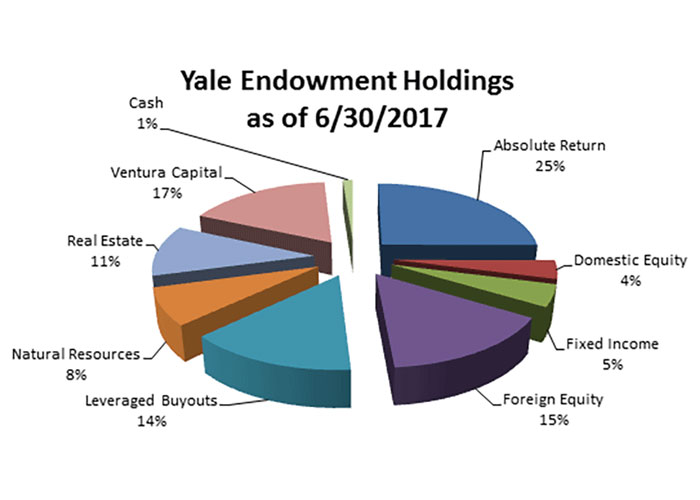

Stocks and bonds have been more correlated in recent years and so, what was once considered a diversified portfolio, does not appear to be providing the balance the current markets demand and clients expect. That is why we believe the Endowment Model which includes many different asset classes, is the best approach to providing clients the degree of portfolio diversification they need. Want to see how the Endowment Model would work for your plan? Call us today.

How the Smart Money Invests

We believe that portfolio construction is about more than stocks and bonds and that creating a diversified portfolio designed to last a lifetime should follow the approach used by many of the world’s most sophisticated investors at the most respected academic institutions. We refer to it as the Endowment Model. It is a philosophy that recognizes true portfolio diversification occurs only when a wide range of alternative asset classes are considered and used in the construction and management of client portfolios.

How We Create and Manage Your Financial Plan

It begins with simple cash flow analysis and an understanding that assets should be managed according to when they will be spent.

Next, we use the timeline created by the cash flow analysis to match asset types to specific time periods they will be used; often in 5-year blocks.

Then we select specific investments by grading money managers’ performance through multiple market cycles. We select those who manage risk and reward best.

Finally we identify market trends to determine periods of heightened risk and periods of lower risk so that we actively manage assets accordingly.

Schedule a Meeting With Us to Learn More

That is our process. It is as sophisticated as it sounds and as simple to implement for clients as you would hope. To learn more or if you would like to have a second set of eyes review your current plan, we would be honored to assist.